This video goes into some more details about covering call options. This strategy is more common among the professional investors but since its not as complicated as most tend to think, it can be quite useful to anyone who takes the time to learn it. This strategy allows you to collect a premium without adding any risk to your long stock position. 05/08/2020 · how to use a covered call options strategy. The key is to educate yourself, and practice, practice, practice.

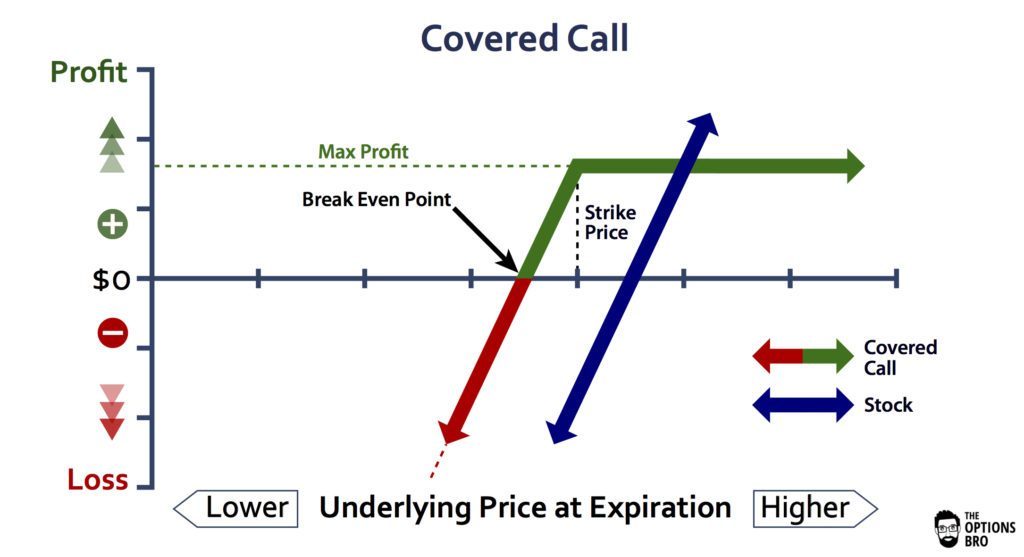

The term covered call refers to a financial transaction in which the investor selling call options owns an equivalent amount of the underlying security.

To execute this, an investor who holds a. 02/04/2019 · covered calls are very common options trading strategy among long stock investors. This strategy allows you to collect a premium without adding any risk to your long stock position. 18/10/2014 · covered calls are a reasonably low risk way for investors to get started with options. This video goes into some more details about covering call options. 05/08/2020 · how to use a covered call options strategy. The key is to educate yourself, and practice, practice, practice. The term covered call refers to a financial transaction in which the investor selling call options owns an equivalent amount of the underlying security. There is a natural progression for an investor who is already accustomed to share ownership to begin to explore the fabulous world of covered calls. Fundamentally, options are a form of financial insurance. Covered call options trading covered call is a fairly common conservative strategy where investors make an attempt to increase the return on their investments. The covered call is a strategy employed by both new and experienced traders. This strategy is more common among the professional investors but since its not as complicated as most tend to think, it can be quite useful to anyone who takes the time to learn it.

A covered call strategy is a type of implementation where a trader will sell a call option while at the same time owning the corresponding amount of the underlying security or instrument. This strategy allows you to collect a premium without adding any risk to your long stock position. This video goes into some more details about covering call options. 18/10/2014 · covered calls are a reasonably low risk way for investors to get started with options. The covered call is a strategy employed by both new and experienced traders.

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

The key is to educate yourself, and practice, practice, practice.

05/08/2020 · how to use a covered call options strategy. There is a natural progression for an investor who is already accustomed to share ownership to begin to explore the fabulous world of covered calls. 18/10/2014 · covered calls are a reasonably low risk way for investors to get started with options. To execute this, an investor who holds a. This strategy allows you to collect a premium without adding any risk to your long stock position. This video goes into some more details about covering call options. The covered call is a strategy employed by both new and experienced traders. The key is to educate yourself, and practice, practice, practice. A covered call strategy is a type of implementation where a trader will sell a call option while at the same time owning the corresponding amount of the underlying security or instrument. How to use a covered call options strategy from trading trainer on vimeo. This strategy is more common among the professional investors but since its not as complicated as most tend to think, it can be quite useful to anyone who takes the time to learn it. Fundamentally, options are a form of financial insurance. Covered call options trading covered call is a fairly common conservative strategy where investors make an attempt to increase the return on their investments.

This video goes into some more details about covering call options. Covered call options trading covered call is a fairly common conservative strategy where investors make an attempt to increase the return on their investments. 02/04/2019 · covered calls are very common options trading strategy among long stock investors. How to use a covered call options strategy from trading trainer on vimeo. A covered call strategy is a type of implementation where a trader will sell a call option while at the same time owning the corresponding amount of the underlying security or instrument.

18/10/2014 · covered calls are a reasonably low risk way for investors to get started with options.

This strategy is more common among the professional investors but since its not as complicated as most tend to think, it can be quite useful to anyone who takes the time to learn it. 02/04/2019 · covered calls are very common options trading strategy among long stock investors. 18/10/2014 · covered calls are a reasonably low risk way for investors to get started with options. 05/08/2020 · how to use a covered call options strategy. The focus, above all, is on simplicity and clarity. This strategy allows you to collect a premium without adding any risk to your long stock position. Fundamentally, options are a form of financial insurance. A covered call strategy is a type of implementation where a trader will sell a call option while at the same time owning the corresponding amount of the underlying security or instrument. This video goes into some more details about covering call options. To execute this, an investor who holds a. There is a natural progression for an investor who is already accustomed to share ownership to begin to explore the fabulous world of covered calls. Covered call options trading covered call is a fairly common conservative strategy where investors make an attempt to increase the return on their investments. The key is to educate yourself, and practice, practice, practice.

48+ Option Trading Covered Calls Gif. The term covered call refers to a financial transaction in which the investor selling call options owns an equivalent amount of the underlying security. The key is to educate yourself, and practice, practice, practice. Covered call options trading covered call is a fairly common conservative strategy where investors make an attempt to increase the return on their investments. The focus, above all, is on simplicity and clarity. This strategy is more common among the professional investors but since its not as complicated as most tend to think, it can be quite useful to anyone who takes the time to learn it.

No comments: